The number

of citizens with a bank account in Latin America has increased by about twenty

percentage points in recent years, reaching nearly 80% in countries like Brazil, Colombia, Mexico, and Peru, according to BBVA. Yet, Latin American Reports

notes that banking penetration in the region remains relatively low, with only

7 out of 10 people maintaining a relationship with a financial institution.

These figures, combined with inflation and a fragmented banking system across

Latin American countries, make international payments a persistent challenge.

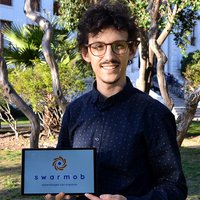

Guillermo

Goncalvez (Venezuela, 30) believes that “the adoption of blockchain and

decentralized finance will be key to lifting millions of people out of poverty

in Latin America.” A graduate in Finance from the Metropolitan University of

Venezuela, Goncalvez has developed El Dorado, a payment platform that

facilitates transactions across Latin America and integrates up to 70 different

payment methods.

“El Dorado

allows users to move money from Pix in Brazil to Pago Móvil in Venezuela or

PayPal in the U.S., instantly and at competitive rates. This solution creates a

path toward financial inclusion in a region otherwise marked by fragmentation,”

Goncalvez explains. He

experienced this need firsthand as a migrant and quickly realized that

peer-to-peer payment platforms democratize access to financial tools. “When

peer-to-peer currency exchange markets emerged, I saw how these platforms

returned control to individuals, allowing them to earn money and operate in a

free-market environment,” he says.

Built on

this vision, El Dorado P2P emerged, a marketplace for users to exchange

stablecoins (tokens with stable value pegged to the U.S. dollar) using dozens

of active payment methods across Latin America. The platform is available

through a mobile app and also via the web.

Since its

launch in 2022, El Dorado has processed over two million payments, serving a

community of more than 250,000 users in countries such as Argentina, Brazil, Colombia, Panama, Peru, and Venezuela. The platform has reduced the cost of

international transfers by over 80% compared to the regional average.

Additionally, merchants using the service have seen their revenues increase by

more than $500,000 (approximately €447,700).

Goncalvez

envisions a broader future for the platform and aims to make El Dorado “the

financial SuperApp of Latin America.” “By leveraging emerging technologies like

cryptocurrencies, we aim to build a financial ecosystem that covers all daily

needs, from payments to savings and investments. The main challenges lie in

scaling the product to more countries, integrating new payment methods,

navigating the region’s complex regulatory landscape, and above all, promoting

financial education among the most vulnerable sectors,” he explains.

“With the

rising prevalence of digital wallets in Latin America and the region’s

inflationary pressures, El Dorado is positioned as a vital tool for financial

transactions, particularly for small and medium-sized enterprises and

individuals,” he adds. Goncalvez

is also a member of Ethereum Caracas, a community of over 400 members, where he

organizes talks to foster collaboration around this cryptocurrency.

Additionally, he has spent the past decade as a member of Caracas Impact Hub,

the largest entrepreneur network in Venezuela. His journey and the impact of El

Dorado have earned him a spot among MIT Technology Review in Spanish 35

Innovators Under 35.